Introduction

Webhook provides a server-to-server messaging system that facilitate communication regarding various transaction types and agreement-related changes. The service enables your systems to receive notifications about important events such as refunds or voids or agreement modifications.

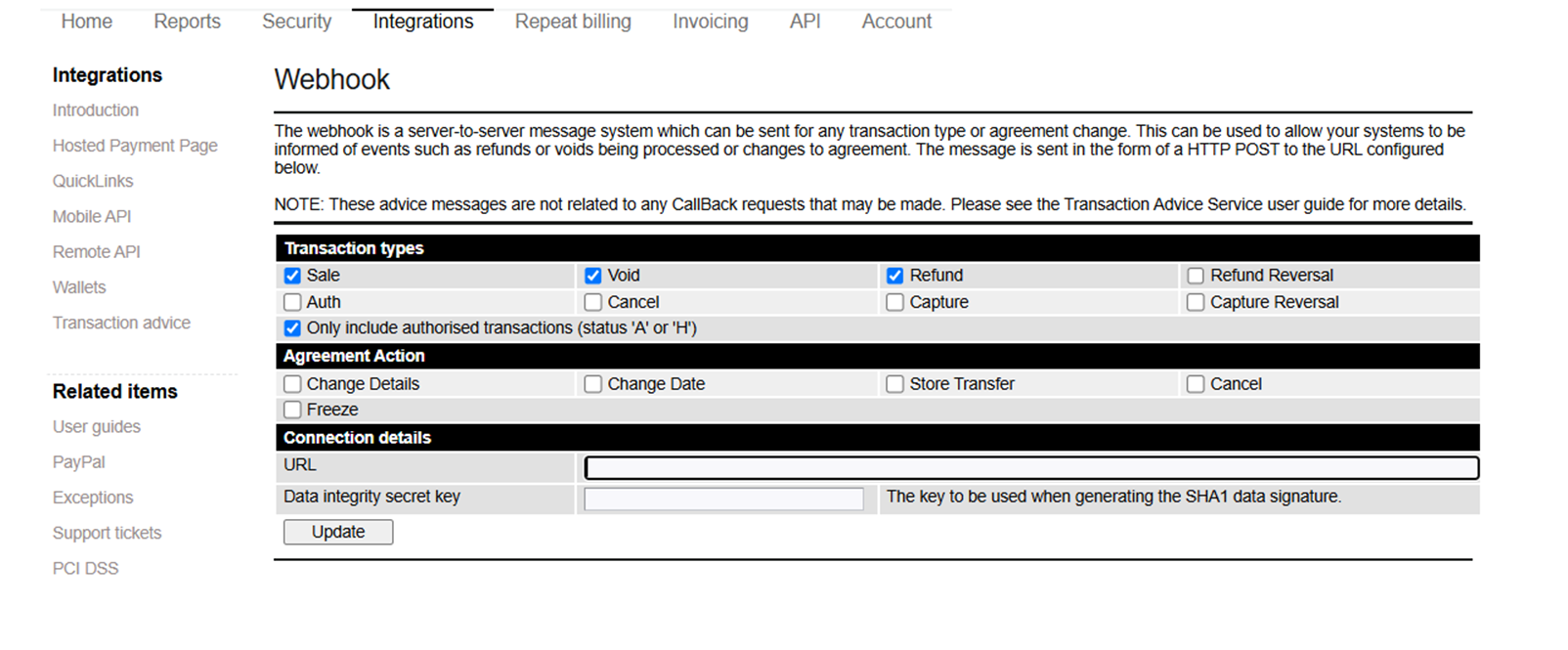

You have the flexibility to choose the specific transaction types or agreement actions you want to receive messages for. Once selected, the webhook service will deliver relevant information for selected actions. These events may include transactions processed through payment processing APIs like Hosted Payment Pages or Remote, manually processed transactions through the Merchant Administration System or agreement-related changes made via the system or API.

Each message is transmitted as an HTTP POST request to a pre-configured URL.

Service configuration

To configure webhook notifications, navigate to the Merchant Administration System and select either the ‘Payment Page’ or ‘Security’ menu, and click on the ‘Transaction advice’ option.

This will display the configuration page, where you can specify the transaction types or agreement action for which you want to receive notifications You can also choose to receive messages only for transactions which have been authorised (transaction status A or H)

In case "Only include authorised transactions (status 'A' or 'H')" option is not selected, then decline transaction data will also be sent along with authorised entries.

You will need to supply the URL that is to be used by the advice service. This URL must use either the HTTP or HTTPS protocol and must be on either port 80 or port 443. The connection that is made to the URL is a direct server-to-server connection, there is no browser involved in the request. The URL used must be accessible over the internet.

Message format

Transaction-Related Webhooks

Transaction-related webhooks are sent using the HTTP POST method and contain the following fields:

| Field | Description |

|---|---|

| tran_store | Your store ID |

| tran_type | Transaction type. See the transcation type and class lists below. |

| tran_class | Transaction class |

| tran_test | Test mode (0 = Live transaction, 1 = Test) |

| tran_ref | Transaction reference |

| tran_prevref | Reference for previous transaction. For transactions which are a follow-up transaction, such as a void, this contains the transaction reference of the transaction being voided. For an initial transaction, such as a sale or auth, this will be the same as the tran_ref. |

| tran_firstref | Reference for the first transaction in a sequence. For example if refund is being performed on a capture transaction, this will contain the reference to the initial auth transaction. |

| tran_order | Order Reference. This parameter is relevant whenever the payment link is generated using the 'order.json' API. Please note this field is not sent by default. If you need the order reference in the response, please contact our support. |

| tran_currency | Transaction currency as 3 character ISO code |

| tran_amount | Transaction amount |

| tran_cartid | Cart ID |

| tran_desc | Purchase description |

| tran_status | Transaction status. ‘A’ or ‘H’ indicate an authorised transaction. Any other value indicates that the request could not be processed. Transactions with status H have been authorised but are on hold. |

| tran_authcode | Authorisation code. If the transaction was authorised, this contains the authorisation code from the acquirer. Otherwise it contains an error code. See the response codes section for more details. |

| tran_authmessage | Authorisation message |

| tran_check | Data signature check. See the section on data security below. |

| card_code | Card identifier two digit code |

| card_payment | Type of payment used |

| bin_number | Card Bank Identification Number (BIN) used to identify the issuing bank and card type. |

| card_issuer | Name of the bank issued the card. |

| card_country | Card country name identified by a two-letter ISO country code. |

| card_last4 | The last four digits of the card number, often used for verification purposes. |

| cart_lang | Language code used for the checkout process |

| integration_id | Integration setup identifier. Identifier for the integration setup or type of integration used to connect with the payment gateway. |

| actual_payment_date | Date and time of the payment |

| bill_title | Title (Mr, Mrs, etc) |

| bill_fname | Forenames |

| bill_sname | Surname |

| bill_addr1 | Street address – line 1 |

| bill_addr2 | Street address – line 2 |

| bill_addr3 | Street address – line 3 |

| bill_city | City |

| bill_region | Region/State |

| bill_country | Country as 2 character ISO code |

| bill_zip | Zip/Area/Postcode |

| bill_phone1 | Phone number |

| bill_email | Email address |

| xtra_ | Extra data fields from the authorisation. |

Transaction types

| Type | Details |

|---|---|

| Sale | A standard online transaction. If authorised the relevant amount will be debited from the customers’ card. |

| Void | A method used to cancel a sale transaction. This can only be done within a short time after the sale transaction was processed. The void amount is always the same as the original sale amount. |

| Refund | Used to credit an amount back to the customer. The refund amount may be the same as or less than the original Sale amount. |

| Refund Reversal | This can be used to cancel a refund, and can only be done within a short time after the refund was processed. Not all acquirers support this transaction type. |

| Auth | A pre-authorisation transaction. This is similar to a sale, but the amount is not immediately debited from the customers’ card. Instead the amount is reserved on that card, and can then be debited at a later date using a capture transaction. Until the capture transaction is processed, no funds will be debited. Release used to release any funds that have previously been reserved by an auth transaction. No funds are debited from the card, and the capture option can no longer be used. |

| Capture | Used to debit funds that have been previously reserved using an auth transaction. This completes the transaction processing. |

| Capture Reversal | This can be used to cancel a capture transaction, and can only be done within a short time after the capture was processed. Not all acquirers support this transaction type. |

In some situations, a transaction may be changed from a Sale to an Auth. If, for example, the original transaction request was for a Sale but the anti-fraud system has flagged the transaction for inspection then it may be converted into an Auth transaction which then requires a Capture in order to be completed.

If your system uses the Sale transaction method, then you should also allow for advice messages relating to Auth, Capture and Release transactions.

Card codes

| Code | Card Type |

|---|---|

| VC | Visa Credit |

| VD | Visa Debit |

| VE | Visa Electron |

| VP | Visa Corporate Purchasing Card |

| VB | Visa Corporate |

| MC | Mastercard Credit |

| MD | Mastercard Debit |

| MA | Mastercard Maestro |

| MM | Mada |

| AM | American Express |

| AP | American Express Corporate Purchasing Card |

| DN | Diners Club |

| JC | JCB |

| DS | Discover |

| A1 | Applepay Visa |

| A2 | Applepay Mastercard |

| A3 | Applepay Amex |

| A4 | Applepay Discover |

| A5 | Applepay JCB |

| A6 | Applepay Mada |

| S1 | Samsungpay Visa |

| S3 | Samsungpay Amex |

| S2 | Samsungpay Mastercard |

| S4 | Samsungpay Discover |

| S5 | Samsungpay JCB |

| S6 | Samsungpay Mada |

| PP | Paypal |

| SP | STC Pay |

| TB | Tabby |

| UP | Union Pay |

| UR | UR Pay |

| JP | Jeel Pay |

| ED | Sadad Bill |

Transaction class codes

| Code | Transaction Type |

|---|---|

| ecom | E-Commerce |

| moto | Mail Order / Telephone Order |

| cont | Continuous Authority |

Agreement-Related Webhooks

Agreement-related webhooks are also sent using the HTTP POST method and contain the following fields:

| Field | Description |

|---|---|

| type | Agreement Type |

| agreement_id | Unique identifier for the agreement. |

| action | Action performed on the agreement |

| store_id | Store ID |

| change_by | Who is updating the action |

| timestamp | Timestamp of the action |

| cancellation_reason | Reason for cancellation |

| cancellation_document_received | Indicates if cancellation document is received |

| email_id | Customer Email ID |

| freeze_start_date | Start date of the freeze period |

| freeze_end_date | End date of the freeze period |

| new_store_id | Agreement transferred to which store |

| due_date | Next payment date |

| description | Description of the agreement |

| cart_id | Cart ID |

| customer_id | Customer ID |

| subscription | Subscription type |

| transaction_id | Transaction ID |

| phone | Customer phone number |

| amount | Regular amount |

| overdue_amount | Overdue amount |

Agreement Actions

| Action | Fields Required |

|---|---|

| CHANGE_DATE | due_date, email_id |

| CHANGE_DETAILS | description, cart_id, customer_id, subscription, transaction_id, email_id, phone, cancel_date, cancellation_reason, cancellation_document_received, amount, overdue_amount |

| FREEZE | freeze_start_date, freeze_end_date |

| STORE_TRANSFER | new_store_id, email_id |

| CANCEL | cancellation_reason, cancellation_document_received, email_id |

Other fields in the agreement-related webhooks are not included as they are common fields applicable to all actions.

Message delivery

The webhook will be generated as soon as the transaction processing has been completed or an agreement action is completed. If there is an error while attempting to deliver the message, then there will be a short delay and a second attempt will be made. Up to 4 attempts in total will be made, with an increasing delay between each attempt.

Your systems must indicate successful receipt of the message by using the HTTP 200 OK response code. Other response codes will be treated as a failure and the message will be repeated.

Data security

To authenticate a webhook message, a SHA1 hash check can be done using key transaction, card, billing information or agreement fields. The process includes these steps:

- Concatenate Field Values: Combine the values of the specified fields using the secret key, separating each value with a colon (:). Make sure not to include the labels.

<secretkey>:<tran_store>:<tran_type>:<tran_class>:<tran_test>:<tran_ref>:<tran_prevref>:<tran_firstref>:<tran_currency>:<tran_amount>:<tran_cartid>:<tran_desc>:<tran_status>:<tran_authcode>:<tran_authmessage>

<secretkey>:<card_code>:<card_payment>:<bin_number>:<card_issuer>:<card_country>:<card_last4>

<secretkey>:<bill_title>:<bill_fname>:<bill_sname>:<bill_addr1>:<bill_addr2>:<bill_addr3>:<bill_city>:<bill_region>:<bill_country>:<bill_zip>:<bill_email>:<bill_phone1>

'agreement_check' (Type is always AGREEMENT and action can be any of the following :CHANGE_DATE/ CHANGE_DETAILS/ FREEZE/ STORE_TRANSFER/ CANCEL)

<secretkey>:<type>:<agreement_id><action>:<due_date>:<email_id>:<store_id>:<change_by>:<timestamp>

<secretkey>:<type>:<agreement_id><action>:<description>:<cart_id>:<customer_id>:<subscription>:<transaction_id>:<email_id>:<phone>:<cancel_date>:<cancellation_reason>:<cancellation_document_received>:<amount>:<overdue_amount>:<store_id>:<change_by>:<timestamp>

<secretkey>:<type>:<agreement_id><action>:<freeze_start_date>:<freeze_end_date>:<store_id>:<change_by><timestamp>

<secretkey>:<type>:<agreement_id><action>:<new_store_id>:<email_id>:<store_id>:<change_by>:<timestamp>

<secretkey>:<type>:<agreement_id><action>:<cancellation_reason>:<cancellation_document_received>:<email_id>:<store_id>:<change_by>:<timestamp>

- If any field value is missing, use an empty value in its place in the concatenated string.

- Convert any percent-encoded characters (e.g., %20) to their corresponding characters.

- Generate the SHA1 Hash: After concatenating the values, create the SHA1 hash of the resulting string.

- Compare Hashes: Match the generated hash with the ones in the tran_check, card_check, or bill_check fields respectively. This confirms the transaction’s integrity and authenticity.

'tran_order' is not sent by default. If you need the order reference in the response, please send a request to [email protected]. If 'tran_order' is enabled, then its value needs to be placed like <tran_firstref>:<tran_order>:<tran_currency>

Message authentication - PHP example

This is an example of authenticating a transaction advice message using the method described in the Data security section.

function SignData($post_data,$secretKey,$fieldList) {

$signatureParams = explode(',', $fieldList);

$signatureString = $secretKey;

foreach ($signatureParams as $param) {

if (array_key_exists($param, $post_data)) {

$signatureString .= ':' . trim($post_data[$param]);

} else {

$signatureString .= ':';

}

}

return sha1($signatureString);

}

$secret_key='[Your Secret Goes Here]';

// Create a check value based on the secret key and the data received.

// To make the following more readable, the field list has been split over two lines

$check=SignData($_POST,$secret_key, 'tran_store,tran_type,tran_class,tran_test,tran_ref,tran_prevref,tran_firstref,tran_order,tran_currency,tran_amount,tran_cartid,tran_desc,tran_status,tran_authcode,tran_authmessage'

// Check that the signature in the message matches the expected value

if (strcasecmp($_POST['tran_check'],$hash_check)!=0) {

// Hash check does not match. Data may have been tampered with.

die('Check mismatch');

}

// Hash check OK, use details supplied in POST data to determine what action to take

// tran_status:

// A = Authorised, H = Authorised but on hold, any other character = not authorised